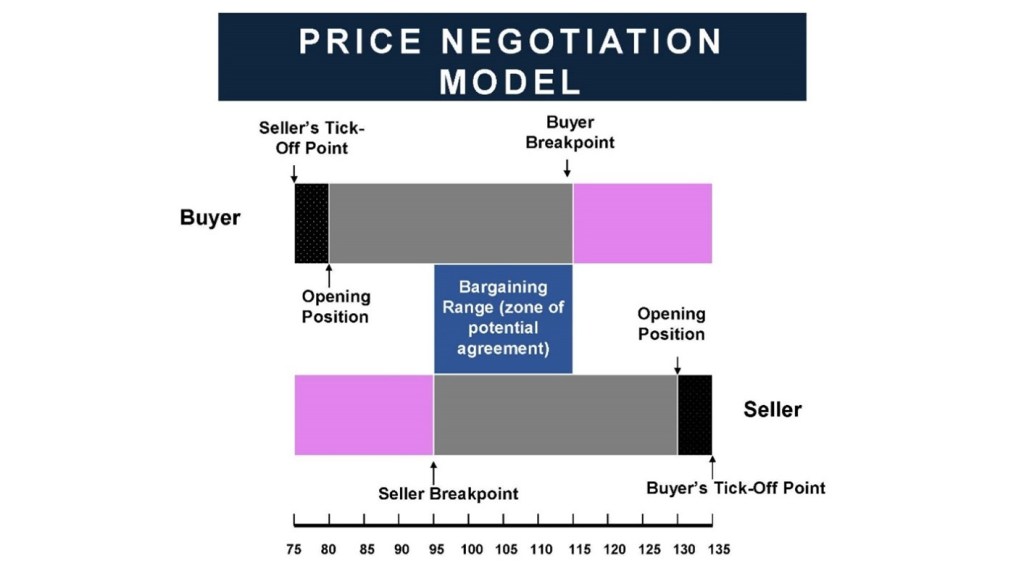

In negotiation, there is always a bargaining range within which a deal can be struck – a zone of potential agreement.

This bargaining range runs from the Seller Breakpoint (the absolute least that the seller will sell their product or service) to the Buyer Breakpoint (the absolute most that the buyer will pay to buy the product or service).

A good negotiator will get more of the value in this bargaining range than a poor negotiator.

- In this model, splitting a difference would mean a deal at 105 halfway between the Seller Breakpoint of 95 and the Buyer Breakpoint of 115.

- A good seller will sell at a price where the buyer pays almost as much as the Buyer Breakpoint. In this model, the good seller will sell at somewhere between 110 to 115.

- A good buyer will buy at a price where the seller sells almost as low as the Seller Breakpoint. In this model, the buyer will buy at somewhere between 95 to 100.

See my blog, Negotiation – An Overview, for some tips on how to be a good negotiator.

But the best negotiators get the most value by negotiating when the bargaining range is most favorable to them.

In short, when we negotiate is as important as how well we negotiate.

Some obvious examples relating to buying a car will highlight this point.

- The economy is strong, and the car market is tight with many cars on back order and low inventory. Your current car breaks down for the final time and you are renting a car to get to work until you buy a new car.

- The economy is weak with inventory stacking up on dealer lots. Your current car is getting old; but still runs well. You would like to buy a new car; but don’t have to.

In which case will the car buyer strike a better deal?

So, how can we master the ‘when’ of negotiation to get the best deal possible?

Buy or Sell When We Still Have Options

We need to begin the buying or selling process when we still have options available and are not desperate to buy or sell. For a buyer, this avoids the first scenario above where he or she will have to pay a higher price. The challenge with doing this is that we all like to hold on to get that better price or to sell when that stock or the economy is just a bit better. We need to avoid this situation and settle for good enough and transact when we have a good (perhaps, not the best) time to transact.

Buy or Sell When the Conditions are Most Favorable

For a buyer, identify the value earlier than other people and buy quickly. For a seller, sell when the market is favorable (and good enough) rather than hanging on.

Three Further Pieces of Advice

Of course, these two pieces of advice are easier said than done. But we can increase our odds of buying or selling when we have options and when the conditions are most favorable in three ways:

Always Be Looking: Keep track of the market of what you want to buy or sell and notice the ups and downs and the general price ranges and keep looking and considering options to buy or sell.

Be Patient: While always looking, be patient to wait for a good time to buy or sell. A little hint: rarely buy or sell when everyone else is doing the same. Buying a house in a hot market or buying a company when mergers and acquisitions are booming rarely work out.

Be Opportunistic: At the same time, when the time is right, take advantage of the opportunity and move quickly to complete the buying or selling.

An anecdote serves to illustrate these ways of mastering the “when” of negotiation.

Earlier in my career, I worked with a large multinational that has had success over the last 45 year in being a serial acquirer of other companies. This success comes the company’s continued focus on acquisitions and acquisition targets. Key managers in the company are always looking to acquire companies. At the same time, the company can be patient. In my role, I started talking to one acquisition candidate in 1996. We finally completed the acquisition, after many ups and downs, in 2004. At the same time, we were opportunistic when the time was right. We completed one deal within two months of first contact.

By following these pieces of advice, we can win the negotiation even before the negotiation has started by mastering the “when” of negotiation.